Every credit union wishes to keep as many of their members as possible. But many struggle to understand which members are likely to leave, which are going to stay and how to get more members to be in the highest retention category.

There are a lot of member attrition models available to the Credit Union market. Many of them, purported to be accurate fail to do the most important thing, which is to keep the member at the Credit Union and not just forecast the likely attrition rate.

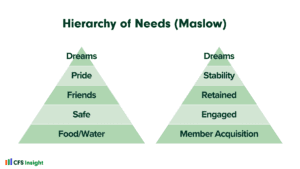

CFS Insight’s Member Retention Analytic Model looks at the members transactional behavior. The model establishes retention categories based on the existence of certain types of key transactions as well as thresholds. The analytical model then assesses the member’s transactional behavior and determines the appropriate retention category for each member using real time intelligence.

CFS Insight’s Member Retention Analytic Model is designed for credit union marketing departments to develop targeted marketing campaigns to help move members to the highest retention category. Additionally, these marketing campaigns can be tracked over time to ensure that they are creating the retention improvements that the Credit Union is looking to achieve.