We get asked quite a bit if we have a ‘Next Best Product’ (NBP) model. It is a reasonable request as the idea of being able to recommend the ’Best’ product for a member seems like a very good idea. Many are surprised that we don’t have a model and have no intention of building one. To understand why, it is best to understand how these models work and to see what they produce.

Market Basket

Many NBP models are created using what is called ‘Market Basket’ analysis. Retail stores like Target perfected this technique to look at what products commonly went together. The idea is that they would want to put items that are common to each other closer together. For instance, if you buy nail polish remover, you probably want cotton balls as well. Or, if you are buying diapers, you will probably also be interested in baby formula.

This is an excellent tool for large retail stores when you have thousands of truly unique items, with some having more of a relationship than others. Putting related items together is both good for the customer, so they don’t forget the related item, but also for the retailer as it drives more sales.

Banking Products

Unfortunately, banking products don’t really look like products that you have in a retail store. When you try to run a market basket analysis on banking products, you immediately encounter a couple of problems.

- There are a lot of flavors of what is essentially the same product. Using CDs as an example, a Credit Union will have dozens of CDs with only slight variations in rate of return and term. These are not really separate products; it is closer to coffee cups with different sizes and colors.

- A very small number of products in a CU represent the vast majority of the product relationships. The member required share, a checking account, and maybe a single loan product will represent the bulk of the connections.

If you look at the recommendations many of these models make, you will notice that they tend to make the same recommendation for almost every member. If they are missing the checking account, that is recommended. If they have the two base share products, then it will recommend the most common loan product in your portfolio. Neither of these recommendations requires a machine-learning model. No additional insight has been gained by training and deploying this model.

Hierarchy of Needs

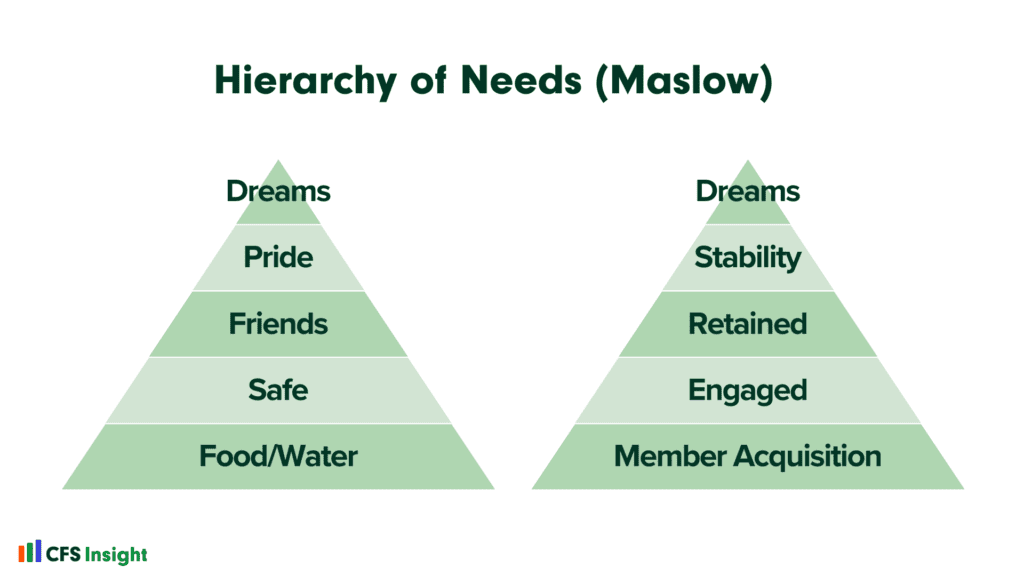

If the NBP doesn’t produce what the CU really wants, what is the alternative? We find Maslow’s hierarchy of needs a useful mental model for recommending the next steps for the member. In Maslow’s model, you need food and water, feel safe, have a social environment, etc., before you can really start to dream.

We use a similar approach when talking about making the next recommendation for a member. Just after signing up a member, you want to make sure that they are engaged with you. Do they have a deposit? Do they have a debit card? Is the member at the highest retention level? Are they financially stable? Do they have an emergency fund? At this point, you can start looking at where they are in their financial lifecycle for loans. Are they older and need to be looking at wealth management products, or are they younger and need to look at a loan product that helps them build credit?

Using this model, there are many steps to ensuring the member is fully engaged and financially healthy before deciding which loan product is best for them at this time. This approach is better suited for CUs that have a more ‘member’ approach and serves the member better in their long-term financial journey.