- Credit Union Data Analytics and Modeling

Empower your credit union with data-driven decision making

Identify risk, growth, and value opportunities by integrating, modeling, and analyzing your data.

The Problem With Credit Union Data

Your credit union wants to make better business strategies using data.

But, your current financial institution lacks the data connections, analytical tools, integrations, modeling, and access for your key stakeholders to use day-to-day. Even if you know what connections need to be made, your internal development resources may lack time, experience or actionable insights. The data is there, and you already know the opportunities for improvement. CFS is here to help.

- Blazing the trail for Credit Union Data Insight

CFS Insight empowers you to get the right data when you need it.

With over 70 credit unions customers, CFS has earned a respectable reputation in analytics capabilities through their business intelligence and data analytics solutions that provide critical insight from core system, 3rd party and custom data sources.

The positive client referrals, testimonials and customer loyalty CFS customers share with other credit unions are proof of their expertise in both the credit union industry and data consulting/development.

- Data Solution Success Stories

What CFS Insight Clients Are Saying…

SELCO Community Credit Union

American Airlines Federal Credit Union

Credit Union of Florida

Michigan State Federal Credit Union

- CFS Data & Analytic Products

Products to connect your systems & model your results.

CFS Insight provides Data Connectors to a Credit Union’s most critical business systems , an Analytics Platform and Pre-Built Credit Union Industry-Specific Data Models that are cutting edge and practical to implement.

Product Categories

- CFS Insight Data Process

The CFS Insight way to unlocking your credit union data

Data connectors and CFS analytical models are just tools. To succeed, your data initiative needs the right process to handle the preparation, detailed integration, and well planned training and support. The CFS process will help guide your project to successful implementation and adoption.

CFS Insight Process

Step 1

Evaluate & Discovery

CFS Insight will act as a guide helping you clarify your goals as they share experiences of other credit unions who have addressed similar challenges. Align your initiative with your leadership’s expectations and confirm that the cost / effort are worth the investment.

Step 2

Create & Deploy

CFS will facilitate the installation, configuration and customization of its software and services in your deployment. Training and knowledge transfer to your team starts immediately and continues through the execution phase.

Step 3

Engage & Onboard

Engage the business stakeholders as the pilot using the insights available. CFS will coach your team on techniques to help end users gain comfort, trust and excitement in leveraging your new capabilities.

Step 4

Support & Review

CFS Insights’ responsive and consultative support is the key gaining valuable feedback and suggestions for improvement from end users. It is the basis for planning enhancements that will distinguish your initiative as one that they rave about vs. talk about.

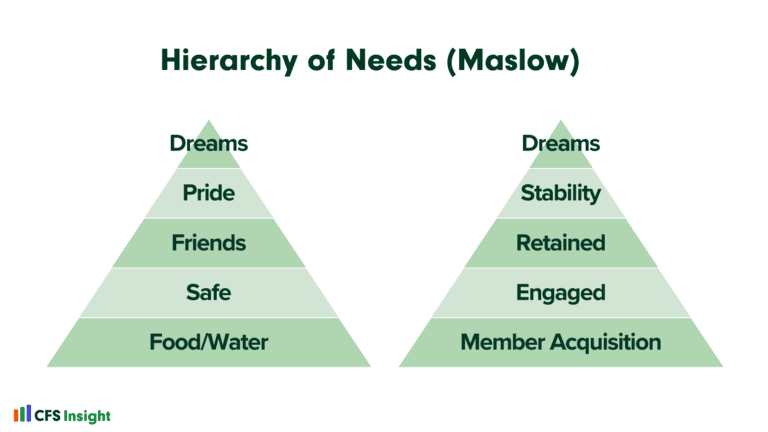

- How CFS Insight can guide you

Ready to make better data driven decisions?

CFS Insight’s process will guide you and your team into advanced analytics and a better understanding of your data. Once your systems are connected, CFS will help you create productive ways to access, analyze, and model your data for deep insights. So the question is — how can we help?

Take Action

You know what you want and you’re ready to chat with the CFS team?

Thought Leadership

Next Best Product (NBP): The Right Recommendation?

We get asked quite a bit if we have a ‘Next Best Product’ (NBP) model. It is a reasonable request as the idea of being

Power BI Best Practices: Managing your data connections

When a credit union is first deploying Power BI, it can be very tempting to click on the SQL Server button and navigate to a

Credit Union Analytics: I Deployed Analytics, and No One Used It

Many credit union analytics professionals will have some variation on the following story. “The client came to me and wanted to deploy an analytics solution

CFS helps you serve

Your Credit Union Community.

- About CFS Insight

Why CFS Cares About Credit Unions

Credit unions want to serve their communities well. Their community may be a region, organization, or identity. But, no matter what their community looks like, credit unions want to see their people thrive.

That’s why for more than a decade, CFS Insight has helped credit unions like yours not only survive, but thrive!